Us bank open business account online – Welcome to the realm of seamless business banking! With US Bank’s online business account opening service, you can establish your business account effortlessly and securely from the comfort of your office or home. Embark on this informative journey as we delve into the advantages, eligibility criteria, account options, fees, security measures, and support resources available through this convenient platform.

Overview of US Bank’s Online Business Account Opening Process

US Bank offers a convenient and efficient online business account opening process that allows businesses to open an account quickly and easily.

Benefits of Opening a Business Account with US Bank Online:

- Convenience: Open your account from anywhere, at any time.

- Efficiency: Complete the application in just a few minutes.

- Security: Your information is protected by industry-leading security measures.

- Support: Get help from our dedicated business banking team if needed.

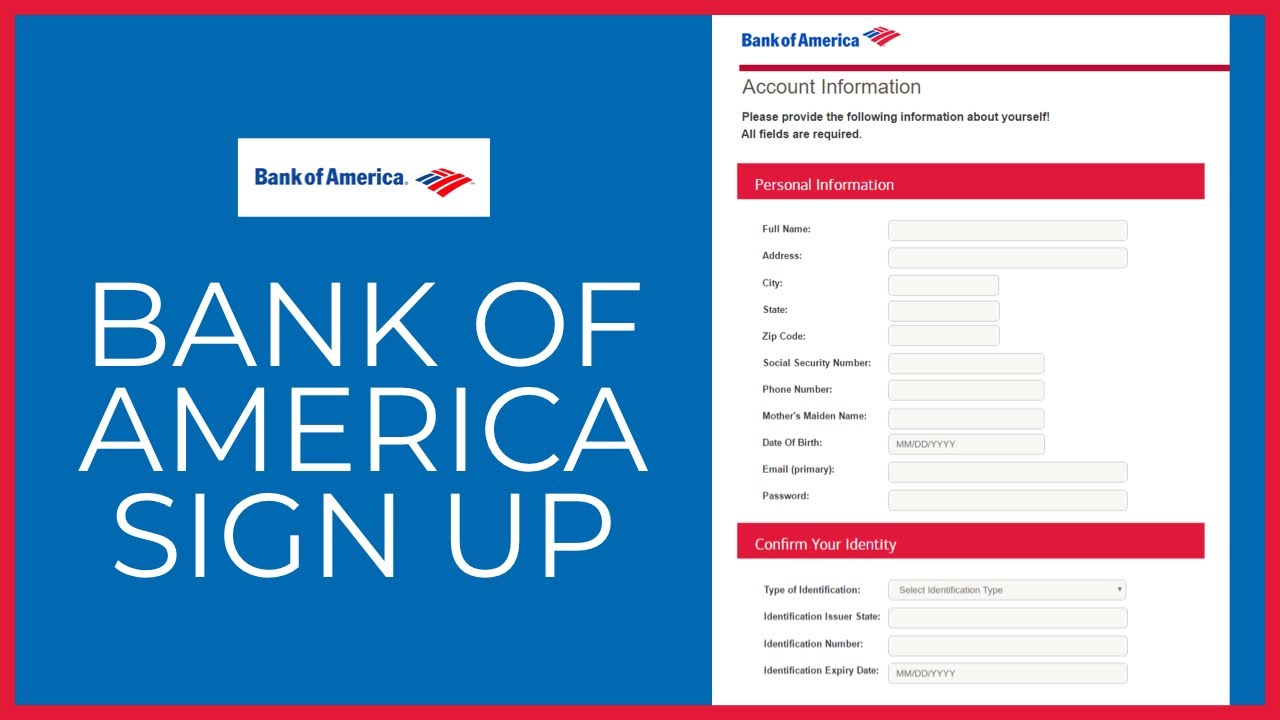

Steps to Start the Online Account Opening Process:

- Visit the US Bank website: Go to www.usbank.com/business-banking.

- Select “Open an Account”: Click on the “Open an Account” button on the homepage.

- Choose a Business Account Type: Select the type of business account you need from the available options.

- Provide Business Information: Enter your business name, address, and other required information.

- Provide Owner Information: Provide information about the business owners, including name, address, and Social Security number.

- Review and Submit: Review the application carefully and submit it for processing.

Eligibility Requirements and Documentation Needed: Us Bank Open Business Account Online

To qualify for opening a business account online with US Bank, your business must meet specific eligibility criteria. Additionally, you’ll need to provide certain documentation and information during the application process.

The following are the key eligibility requirements:

- Your business must be a legal entity, such as a corporation, LLC, or partnership.

- Your business must be based in the United States.

- You must have a valid Employer Identification Number (EIN) or Social Security Number (SSN) for the business.

When applying for a business account online, you’ll need to provide the following documentation and information:

- Business formation documents, such as articles of incorporation or a partnership agreement.

- A copy of your business license or registration.

- A voided check from your current business bank account.

- Your EIN or SSN.

- Contact information for your business, including address, phone number, and email address.

By meeting the eligibility requirements and providing the necessary documentation, you can streamline the online business account opening process with US Bank.

Account Types and Features

US Bank offers a range of business accounts through its online platform, each tailored to meet the specific needs of different businesses.

The main account types available include:

Business Checking Accounts

- Designed for everyday business transactions, such as deposits, withdrawals, and check writing.

- Offer various features like mobile banking, online bill pay, and access to a network of ATMs.

Business Savings Accounts

- Ideal for businesses looking to save for future expenses or investments.

- Provide competitive interest rates and may offer tiered interest structures for higher balances.

Money Market Accounts

- Combine features of checking and savings accounts, offering both check-writing capabilities and higher interest rates.

- Typically require a minimum balance to earn the highest interest rates.

Certificates of Deposit (CDs)

- Fixed-term accounts that offer a fixed interest rate for a predetermined period.

- Provide higher interest rates than traditional savings accounts but restrict access to funds during the term.

Fees and Charges

Opening and maintaining a business account with US Bank involves certain fees and charges that vary depending on the account type and services used.

It’s important to be aware of these fees to make informed decisions and manage your business finances effectively.

Minimum Balance Requirements

Some US Bank business accounts have minimum balance requirements that must be maintained to avoid monthly maintenance fees. Failure to meet the minimum balance may result in additional charges.

Monthly Maintenance Fees

Certain US Bank business accounts charge a monthly maintenance fee if the account balance falls below the minimum balance requirement. The monthly maintenance fee varies depending on the account type and ranges from $10 to $25.

Other Fees

- Transaction Fees: Fees may be charged for certain transactions, such as wire transfers, ACH transfers, and check deposits.

- Overdraft Fees: If your account balance becomes negative, you may be charged an overdraft fee.

- Returned Item Fees: Fees may be charged if a check or other payment item is returned due to insufficient funds or other reasons.

Security Measures

US Bank prioritizes the safety and security of its customers’ financial information. To ensure the protection of sensitive data, the bank has implemented robust security measures to safeguard online account transactions.

These measures include:

Encryption

- US Bank utilizes advanced encryption technology to protect data during transmission and storage, ensuring that it remains confidential and inaccessible to unauthorized individuals.

Multi-Factor Authentication

- Multi-factor authentication adds an extra layer of security by requiring users to provide multiple forms of identification, such as a password, security question, or one-time passcode, when accessing their accounts.

Fraud Monitoring

- US Bank employs sophisticated fraud monitoring systems that analyze account activity in real-time, detecting and flagging suspicious transactions to prevent unauthorized access and fraudulent activities.

Secure Socket Layer (SSL)

- The bank’s website utilizes SSL technology to establish a secure connection between the user’s browser and the bank’s servers, encrypting all transmitted data to protect it from interception.

Regular Security Audits

- US Bank conducts regular security audits to identify and address potential vulnerabilities, ensuring that its security measures remain effective and up-to-date.

Customer Support and Resources

US Bank provides comprehensive customer support and resources to assist businesses with their banking needs.

Customers can access support through multiple channels, including online chat, phone, and email. The bank also offers a dedicated business support center with extended hours, ensuring prompt assistance.

Online Support

- Live chat: Businesses can connect with a customer service representative in real-time through the US Bank website.

- Email support: Businesses can submit inquiries via email and receive responses within a specified timeframe.

Phone Support

- Business support center: Businesses can call a dedicated phone line for assistance with account-related inquiries, transactions, and general banking questions.

Additional Resources, Us bank open business account online

US Bank offers a range of additional resources to support businesses, including:

- Online knowledge base: A comprehensive repository of articles and FAQs covering various banking topics.

- Webinars and workshops: Educational sessions conducted by banking experts to provide insights and guidance on financial management and banking best practices.

- Dedicated account managers: Businesses can connect with a dedicated account manager for personalized assistance and guidance.

Closing Summary

Opening a business account with US Bank online is a smart move for businesses seeking efficiency, security, and flexibility. Whether you’re a seasoned entrepreneur or just starting out, this service empowers you to manage your finances effectively and focus on growing your business. Embrace the digital banking revolution and unlock the potential of US Bank’s online business account today!

FAQ Guide

What are the benefits of opening a business account online with US Bank?

Convenience, time-saving, access to online banking tools, and streamlined account management.

What eligibility criteria must I meet to open a business account online?

Valid business license or formation documents, EIN, personal identification, and business information.

What types of business accounts are available online?

Basic business checking, business savings, and business money market accounts.

Are there any fees associated with opening and maintaining a business account?

Monthly maintenance fees may apply, depending on the account type and balance.

How secure is the online account opening process?

US Bank employs robust security measures, including encryption, multi-factor authentication, and fraud monitoring.