Switch to paypal business account – In the realm of digital commerce, PayPal Business Accounts stand as a cornerstone for businesses seeking to streamline their financial operations. With its suite of tailored features and robust security measures, switching to a PayPal Business Account empowers businesses to elevate their financial management and unlock a world of growth opportunities.

This comprehensive guide delves into the intricacies of switching to a PayPal Business Account, providing a step-by-step roadmap to navigate the process seamlessly. From understanding the benefits and features to exploring the pricing structure and customer support options, this guide equips businesses with the knowledge and insights they need to make an informed decision and optimize their financial journey with PayPal.

Introduction to Switching to a PayPal Business Account

Transitioning to a PayPal Business Account can be an advantageous move for businesses seeking enhanced financial management and growth opportunities. This account offers a comprehensive suite of features and services tailored specifically to meet the needs of businesses of all sizes.

PayPal Business Accounts empower businesses with the ability to accept payments from various sources, including credit cards, debit cards, and PayPal balances. This versatility allows businesses to cater to a broader customer base and maximize their revenue potential.

Benefits of Using a PayPal Business Account, Switch to paypal business account

- Enhanced Security: PayPal Business Accounts adhere to industry-leading security standards, safeguarding businesses and their customers from fraud and unauthorized transactions.

- Seamless Integration: PayPal Business Accounts can be seamlessly integrated with popular e-commerce platforms and shopping carts, simplifying payment processing and streamlining operations.

- Customizable Invoicing: Businesses can create and send professional invoices with customized branding and payment options, enhancing their professional image and streamlining the billing process.

- Advanced Reporting: PayPal Business Accounts provide detailed transaction reports, enabling businesses to track sales, identify trends, and make informed financial decisions.

- Dedicated Support: Businesses using PayPal Business Accounts have access to dedicated customer support, ensuring prompt assistance and resolution of any queries or issues.

Examples of Businesses That Can Benefit from a PayPal Business Account

- E-commerce Stores: Online retailers can leverage PayPal Business Accounts to accept payments from customers worldwide, providing a secure and convenient checkout experience.

- Freelance Professionals: Freelancers and independent contractors can use PayPal Business Accounts to receive payments from clients and manage their finances efficiently.

- Subscription Services: Businesses offering subscription-based services can utilize PayPal Business Accounts to automate recurring payments and manage customer subscriptions.

- Non-Profit Organizations: Non-profit organizations can utilize PayPal Business Accounts to accept donations, track expenses, and manage their financial operations effectively.

Step-by-Step Guide to Switching to a PayPal Business Account

Transitioning from a personal PayPal account to a business account is a straightforward process that can be completed in a few simple steps. By following the detailed guide below, you can seamlessly switch to a PayPal Business Account and unlock its enhanced features tailored for business operations.

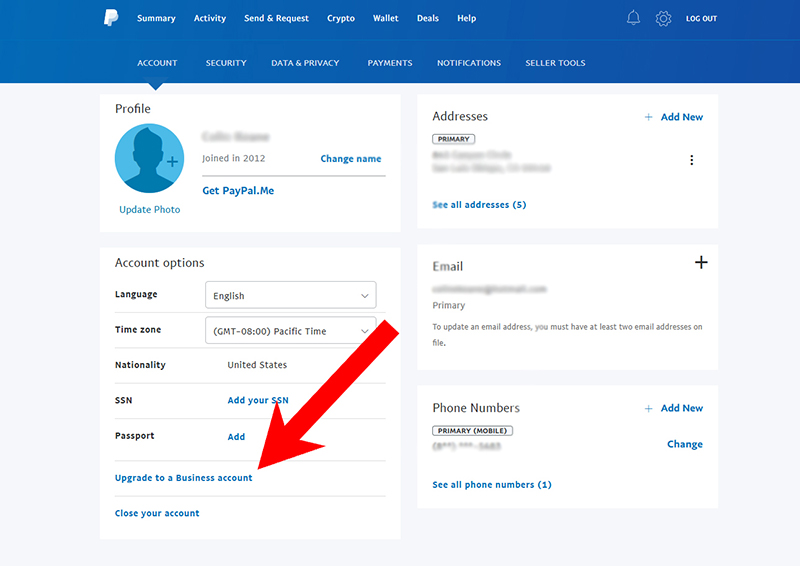

Navigating to the Business Account Setup Page

Begin by logging into your personal PayPal account. Once you’re logged in, click on the “Profile” tab located in the top right corner of the page. From the drop-down menu, select “Upgrade to a Business Account.” This will redirect you to the PayPal Business Account setup page.

Fees and Pricing for PayPal Business Accounts

PayPal Business Accounts come with various fee structures depending on the account type and the services used. Understanding these fees is crucial for businesses to optimize their payment processing costs.

Factors that affect the fees charged include:

- Account type (Standard, Pro, Premium)

- Transaction volume

- Currency conversion

- Payment method (e.g., credit card, PayPal balance)

Fee Structure Comparison

| Account Type | Standard | Pro | Premium |

|---|---|---|---|

| Monthly Fee | $0 | $30 | $75 |

| Transaction Fee | 2.9% + $0.30 | 2.59% + $0.30 | 2.29% + $0.30 |

| Currency Conversion Fee | 3.5% | 2.5% | 1.5% |

Calculating Fees

To calculate the fees for a specific transaction, use the following formula:

Fee = Transaction Amount * Transaction Fee + (Transaction Amount * Currency Conversion Fee)

For example, a $100 transaction with a 2.9% transaction fee and a 3.5% currency conversion fee would incur a total fee of $3.57:

Fee = $100 * 0.029 + ($100 * 0.035) = $3.57

Security and Fraud Protection for PayPal Business Accounts: Switch To Paypal Business Account

PayPal employs robust security measures to protect businesses from fraud, including:

- Encryption of sensitive data

- Advanced fraud detection systems

- Two-factor authentication

- Account monitoring and alerts

Steps Businesses Can Take to Enhance Security

Businesses can further enhance the security of their PayPal accounts by:

- Using strong passwords and changing them regularly

- Enabling two-factor authentication

- Reviewing account activity regularly

- Reporting suspicious activity to PayPal immediately

Common Fraud Schemes and How to Avoid Them

Common fraud schemes include:

- Phishing scams: Emails or text messages that appear to be from PayPal but are actually fraudulent attempts to obtain sensitive information.

- Chargebacks: Unauthorized transactions that are disputed by the cardholder.

- Fake invoices: Emails or websites that request payment for goods or services that were not ordered.

To avoid these scams, businesses should:

- Never share sensitive information via email or text message

- Verify the legitimacy of invoices before making payment

- Report suspicious activity to PayPal immediately

Customer Support for PayPal Business Accounts

PayPal Business Account holders have access to a range of customer support options to assist them with account-related issues and queries.

These options include:

Phone Support

- Dedicated phone lines for business account holders

- Available 24/7 for urgent assistance

- Speak directly to a customer support representative

Email Support

- Submit support requests via email

- Receive detailed responses from customer support team

- Track the status of support requests online

Online Help Center

- Comprehensive knowledge base with articles and FAQs

- Search for specific topics or browse through categories

- Self-help resources for resolving common issues

Community Forums

- Connect with other PayPal business users

- Share experiences, ask questions, and get peer support

- Access to PayPal moderators and experts

Examples of how customer support can help businesses resolve problems:

- Resetting forgotten passwords

- Resolving account limitations or suspensions

- Investigating unauthorized transactions

- Providing guidance on account management and best practices

- Offering technical support for integration issues

Outcome Summary

As the curtain draws on this exploration of PayPal Business Accounts, it becomes evident that this financial tool is not merely a switch but a strategic investment in the growth and success of any business. Its seamless integration, robust security measures, and dedicated customer support make it an indispensable ally for businesses navigating the ever-evolving landscape of digital commerce.

By embracing the power of PayPal Business Accounts, businesses unlock a world of possibilities, empowering them to manage their finances with greater efficiency, protect their assets from fraud, and elevate their customer experience. The switch to a PayPal Business Account is not just a transaction; it is a transformative step towards financial empowerment and business success.

Top FAQs

What are the key benefits of using a PayPal Business Account?

PayPal Business Accounts offer a range of benefits tailored to the needs of businesses, including seamless payment processing, robust fraud protection, dedicated customer support, and access to a global customer base.

How do I switch from a personal PayPal account to a business account?

Switching from a personal PayPal account to a business account is a straightforward process that can be completed online. Simply navigate to the PayPal website, click on the “Business” tab, and follow the prompts to create your business account.

Are there any fees associated with PayPal Business Accounts?

Yes, PayPal Business Accounts have varying fee structures depending on the plan and transaction volume. These fees typically include a per-transaction fee, a monthly account fee, and currency conversion fees.

How does PayPal protect businesses from fraud?

PayPal employs a multi-layered approach to fraud protection, including advanced risk analysis, seller protection policies, and buyer protection programs. Businesses can further enhance their security by implementing strong passwords, enabling two-factor authentication, and monitoring their account activity regularly.

What customer support options are available for PayPal Business Account holders?

PayPal Business Account holders have access to a range of customer support options, including phone, email, and live chat support. Additionally, PayPal offers a comprehensive online help center with FAQs, tutorials, and troubleshooting guides.