Discover the Small Business Map American Express, an invaluable resource designed to propel small businesses toward success. This comprehensive program offers an array of benefits, features, and support tailored to the unique needs of entrepreneurs and small business owners.

The Small Business Map American Express is not just a credit card; it’s a powerful tool that empowers small businesses to unlock their potential. With its exclusive benefits, flexible rewards structure, and dedicated support, this program is a game-changer for businesses seeking growth and prosperity.

Overview of Small Business Map American Express

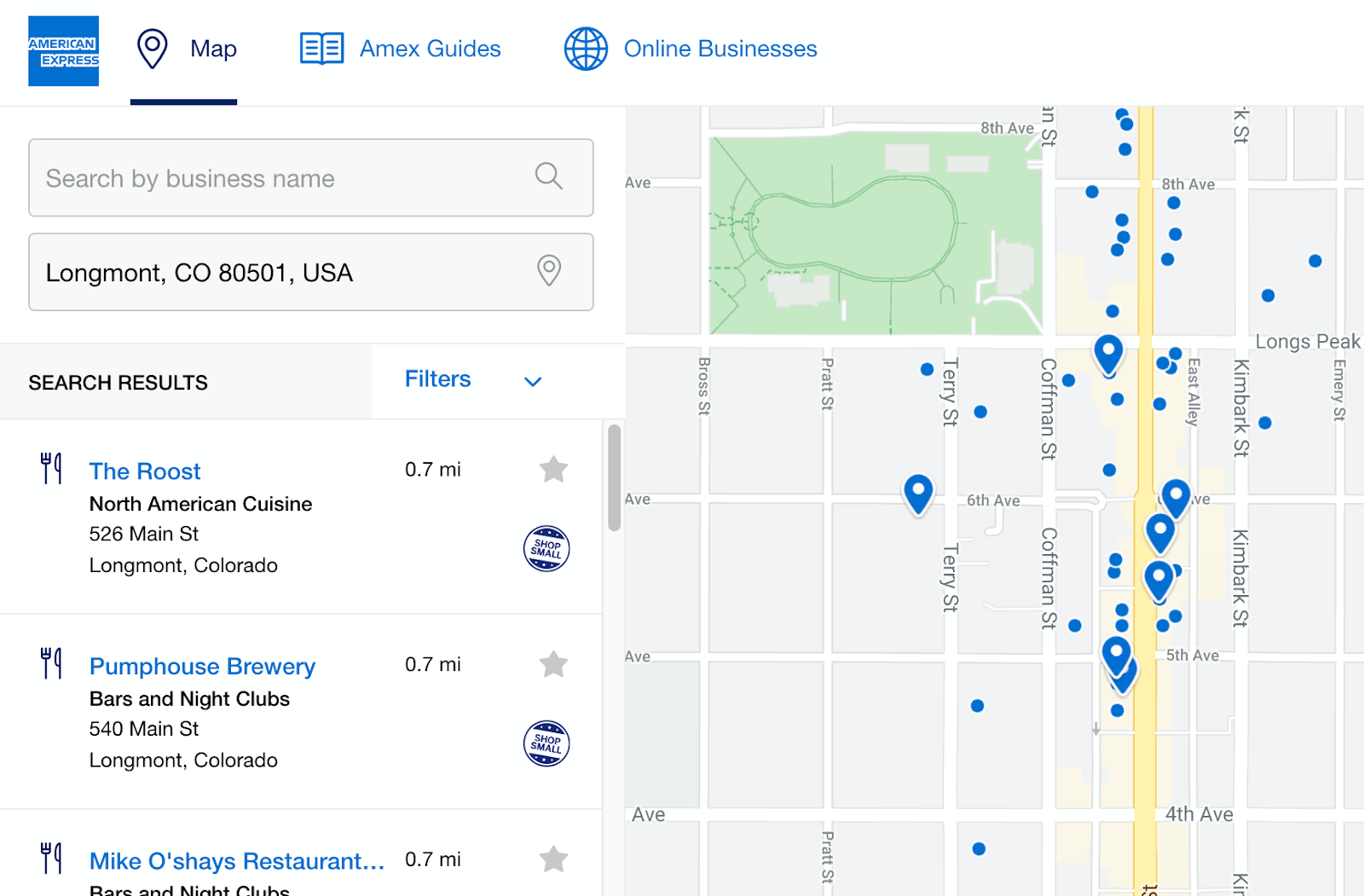

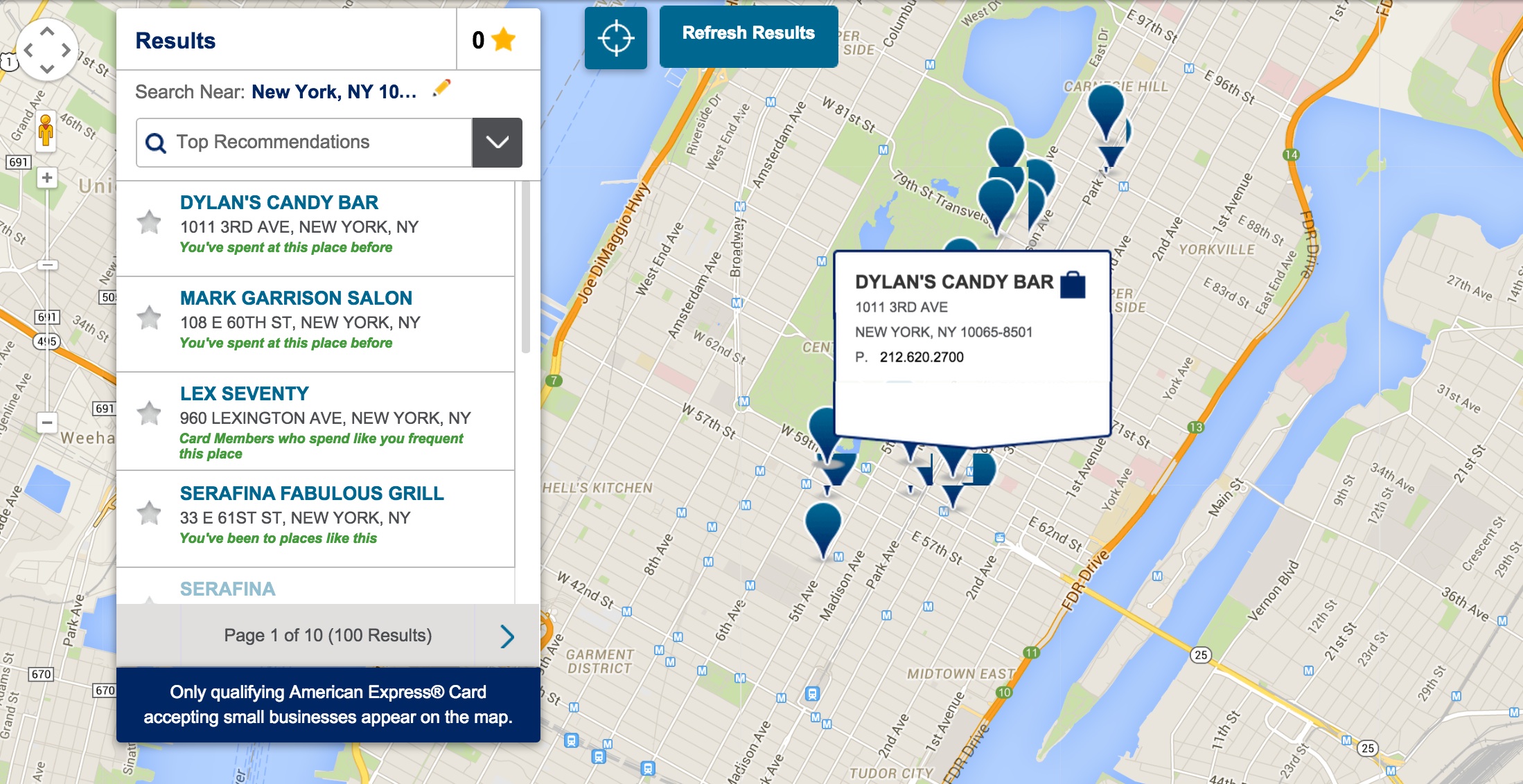

The Small Business Map American Express is an online platform designed to support and empower small businesses in the United States.

Launched in 2010, the program offers a range of resources and benefits to small business owners, including access to financial tools, marketing support, and networking opportunities.

Purpose and Benefits, Small business map american express

- Provide small businesses with access to financial resources, such as loans and grants.

- Offer marketing support, including website development and social media marketing.

- Connect small businesses with other entrepreneurs and potential customers.

- Promote small businesses and their contributions to the economy.

Benefits for Small Businesses

The Small Business Map American Express offers numerous benefits and features tailored to support the growth and success of small businesses. These include:

Enhanced financial management tools, exclusive networking opportunities, and tailored business support services. By leveraging these advantages, small businesses can optimize their operations, connect with potential customers and partners, and access valuable resources to drive their business forward.

Financial Management Tools

- Access to business loans and lines of credit

- Dedicated business checking accounts with competitive interest rates

- Merchant services for secure and convenient payment processing

- Expense tracking and management tools to streamline financial operations

- Financial planning and advisory services to optimize business strategies

Networking Opportunities

- Exclusive access to industry events and conferences

- Member-only networking platforms for connecting with other small business owners

- Mentorship and coaching programs from experienced business professionals

- Opportunities to collaborate with other businesses on joint ventures or partnerships

- Recognition and awards programs to showcase successful small businesses

Business Support Services

- Dedicated customer service and technical support

- Access to online resources and educational materials

- Business planning and consulting services to guide growth strategies

- Marketing and advertising support to reach new customers

- Exclusive discounts and promotions on business essentials

For example, a small business owner could utilize the expense tracking tools to monitor and control expenses, identify areas for cost optimization, and make informed financial decisions. They could also leverage the networking opportunities to connect with potential investors, partners, and customers, expanding their business reach and visibility.

Eligibility and Application Process

To qualify for the Small Business Map American Express, your business must meet the following eligibility criteria:

- Be a for-profit business

- Be based in the United States

- Have been in operation for at least two years

- Have annual revenue of less than $10 million

- Have a strong credit history

To apply for the Small Business Map American Express, you can visit the American Express website or call their customer service line. The application process is simple and takes just a few minutes to complete.

Required Documents

When you apply for the Small Business Map American Express, you will need to provide the following documents:

- Your business tax ID number

- Your business financial statements

- A copy of your driver’s license or passport

Once you have submitted your application, it will be reviewed by American Express. If you are approved, you will receive your card within 7-10 business days.

Fees and Rewards

The Small Business Map American Express card comes with both fees and rewards that businesses should be aware of before applying.

In terms of fees, there is an annual fee of $95. Additionally, there are transaction fees for certain types of transactions, such as foreign currency transactions and cash advances.

Rewards Structure

The Small Business Map American Express card offers a rewards structure that allows businesses to earn points on their purchases. These points can then be redeemed for a variety of rewards, including travel, gift cards, and statement credits.

- Earn 2 points per dollar on purchases made at U.S. office supply stores and on wireless telephone services purchased directly from U.S. service providers.

- Earn 1 point per dollar on all other purchases.

Businesses can redeem their points for a variety of rewards, including:

- Travel: Flights, hotels, and rental cars

- Gift cards: From popular retailers and restaurants

- Statement credits: To reduce their monthly balance

The redemption value of points varies depending on the reward being redeemed.

Comparison with Other Small Business Credit Cards

The Small Business Map American Express offers a competitive package of fees, rewards, and benefits. To help you make an informed decision, we have compared it with other popular small business credit cards.

Fees

- The Small Business Map American Express has an annual fee of $95, which is lower than the annual fees of many other small business credit cards.

- There is no balance transfer fee, which is a fee that some other small business credit cards charge.

- There is a foreign transaction fee of 2.7%, which is in line with the industry average.

Rewards

- The Small Business Map American Express offers 2% cash back on all purchases, which is a higher cash back rate than many other small business credit cards.

- There is no limit to the amount of cash back you can earn, and you can redeem your cash back for statement credits, gift cards, or travel.

Benefits

- The Small Business Map American Express offers a variety of benefits, including purchase protection, extended warranty protection, and travel insurance.

- Cardholders also have access to American Express’s online business tools and resources, which can help you manage your business.

Eligibility Criteria

- To be eligible for the Small Business Map American Express, you must have a good to excellent credit score.

- You must also have a business that has been operating for at least two years.

- Your business must have annual revenue of at least $100,000.

Case Studies and Success Stories

Numerous small businesses have reaped the benefits of the Small Business Map American Express program. These case studies demonstrate how the program has aided their growth and success.

One notable example is a small bakery in a rural town. By utilizing the program’s rewards and financing options, the bakery was able to expand its operations and increase its customer base, resulting in a significant increase in revenue.

Another Success Story

Another success story is a clothing boutique that used the program’s marketing tools to reach a wider audience. The boutique’s online presence and social media following grew exponentially, leading to a surge in sales and brand recognition.

Tips for Maximizing Benefits: Small Business Map American Express

To fully harness the advantages offered by the Small Business Map American Express, consider implementing these practical tips and strategies:

Maximize rewards through strategic spending and expense management to optimize your financial returns.

Maximizing Rewards

- Align spending with bonus categories: Identify the categories that offer the highest rewards and focus your purchases accordingly.

- Utilize the Membership Rewards program: Convert earned points into travel, gift cards, or cash back to maximize their value.

- Combine rewards with other programs: Explore opportunities to combine rewards earned through the Small Business Map with other loyalty programs.

Managing Expenses

- Monitor expenses diligently: Utilize the online portal or mobile app to track spending patterns and identify areas for optimization.

- Set spending limits: Establish clear spending limits to prevent overspending and maintain financial discipline.

- Automate payments: Set up automatic payments to avoid late fees and maintain a positive credit history.

Concluding Remarks

In conclusion, the Small Business Map American Express is an indispensable partner for small businesses seeking to elevate their operations and achieve their entrepreneurial dreams. Its comprehensive suite of benefits, tailored support, and flexible rewards structure empower businesses to overcome challenges, seize opportunities, and build a thriving future.

FAQ Guide

What are the key benefits of the Small Business Map American Express?

The Small Business Map American Express offers a range of benefits, including flexible rewards, tailored financing options, business protection services, and dedicated support.

How do I apply for the Small Business Map American Express?

To apply for the Small Business Map American Express, you can visit the American Express website or contact a business banking representative.

What is the eligibility criteria for the Small Business Map American Express?

To be eligible for the Small Business Map American Express, your business must be a for-profit, non-governmental organization with annual revenue below a certain threshold.